As part of our continued effort to provide businesses with the means to submit all of their company returns from within Clear Books, we are pleased to announce that you can now file your P35 End of Year Return and P14s from Open Payroll.

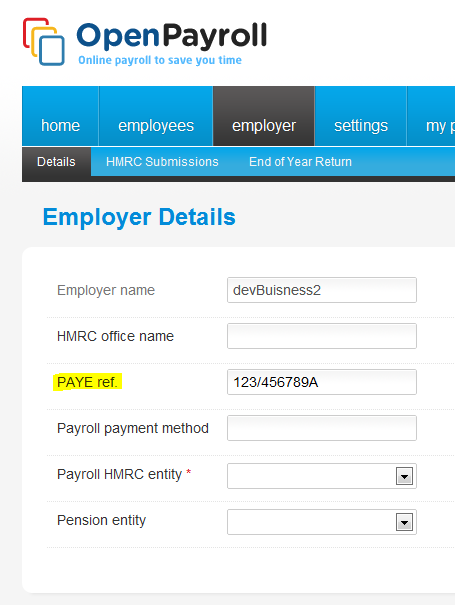

If you’ve been using Open Payroll for all of your employees for the 2011-2012 financial year, then it should already contain most of the data that you will need to submit to HMRC in the form of P14s and a P35. You just need to make sure that we know your PAYE reference, which can be entered under ‘Employer > Details’ as shown below.

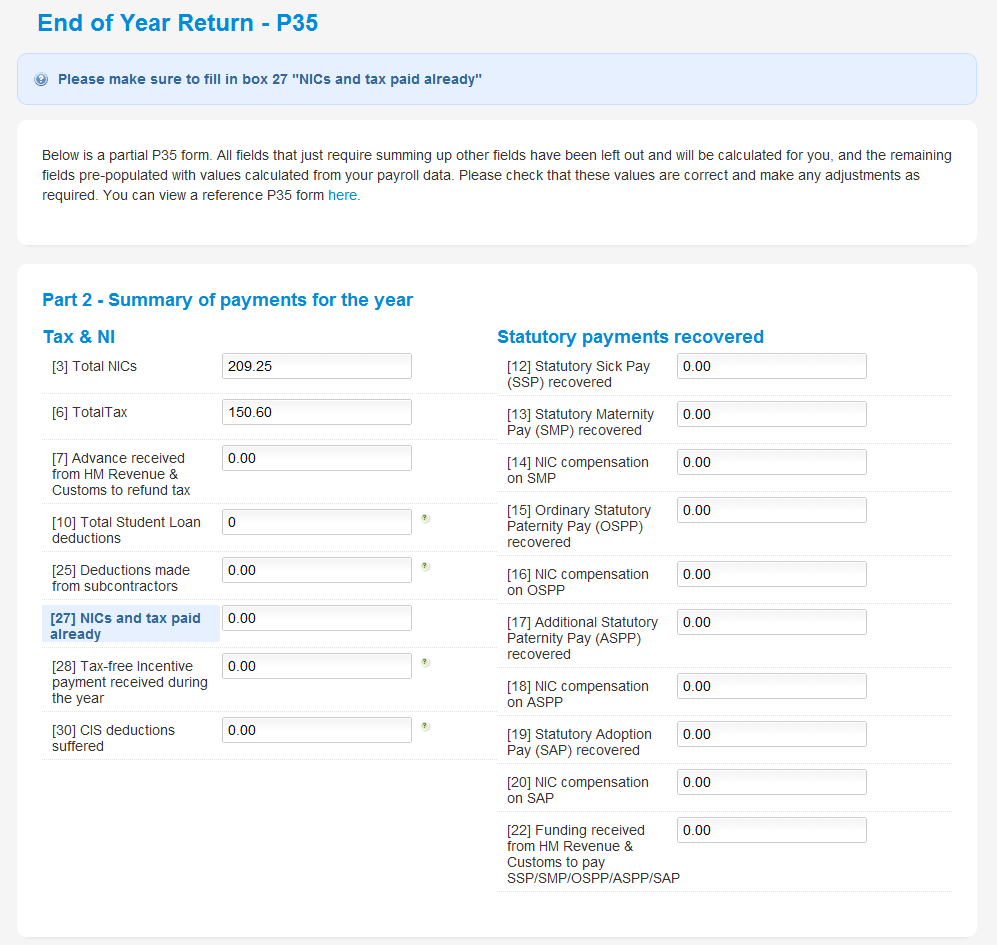

Once you’ve entered your PAYE Reference, you can start your return by navigating to ‘Employer > End of Year Return’. After selecting the employees you wish to include in your return, you’ll be presented with a P35 form to fill in.

Make sure to fill in the amount of NICs and Tax that you’ve already paid to HMRC and any other information such as CIS deductions. After answering the rest of the questions and making the employer declarations, you will be asked to confirm the details that are about to be submitted. If you’re happy with the information, press confirm and your submission will be sent to HMRC!

After your return has been submitted, you can check its status by navigating to ‘Employer > HMRC Submissions’. Please note that this return will not show up on the HMRC website as it was submitted using 3rd party software.

You will be able to print P60 certificates straight from Open Payroll as soon as we get the design approved by HMRC. Until then, the employee’s P14 contains the necessary information to fill in your own P60 if you need to issue them urgently.